Market Overview

Have a look ...World Tube & Pipe Market: Factors influencing the current situation

Dr. Gunther Voswinckel – Update as per October 2021

Welcome back to ITA’s regular presentation of the main worldwide economic factors influencing the tube and pipe industry. In this article we discuss several economic consequences for the tube and pipe industry, arising from the unusual situation caused by Covid 19. In many regions of the world, the corona pandemic has been brought partly under control. In the latter months of 2021, we witnessed an impressive restart of the industry. The demand for energy is booming whereas the supply chains are seriously disrupted. International expenditure programs, established to counteract the economic consequences of the pandemic, flooded the markets with money. And so after a long period of financial stability, we now see signs of upcoming inflation.

After a disastrous 2020, characterized by shrinking market demand, some tube and pipe producers closed their production facilities. By contrast, 2021 has been defined by increased demand, followed by an enormous price and cost rally combined with deficits in the supply chains. It would seem that the price and cost surges peaked this fall 2021, although supply chains, energy costs and the sourcing of qualified labour still present challenges. However, the market in principle provides enough tube and pipe producing capacity to serve the demand, and so will likely calm down as soon as demand and supply can be balanced again.

Still, energy costs will remain challenging for high energy consuming industries like the steel tube and pipe industry. Strategic measures for our industry are consequently quite demanding. Lean and agile organizations with flexible, customer-orientated production facilities are the best answer to demanding and volatile market requirements. Agile digital solutions in the spirit of “Industry 4.0” offer further opportunities to stay successful.

The International Tube Association organized several well attended webinars in 2020 and 2021 as well as the virtual fair ITA netForum 2020 to substitute the cancelled TUBE Düsseldorf 2020 to keep the exchange of our industry ongoing. This September 2021 new technologies were successfully presented at the FABTECH exhibition in Chicago. The ITA was also present with a booth to serve its members.

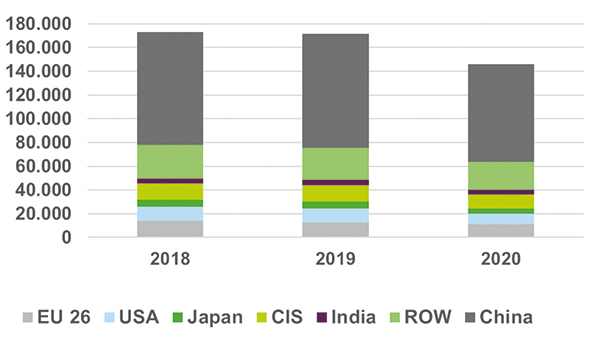

We are also looking forward for great exchange of our industry at our world largest tube and pipe show “Tube Düsseldorf” in May 2022. The year 2020 was disastrous for the tube and pipe industry. World tube production fell by 15% (Fig.1), with the USA (-24%) and Japan (-21%) the worst hit. The smallest decline was reported for seamless pipes at -10%. Much higher production cutbacks were reported for welded pipes >16”, with losses of up to 27%. Line pipe projects were postponed or stopped altogether, due to the pandemic.

Many supply chains were disrupted and in consequence some production facilities were shut down. Pipe and tube prices went down by 4% in the first 3 quarters of 2020, stabilizing in the 4th quarter 2020 due to an increase in tube and pipe demand.

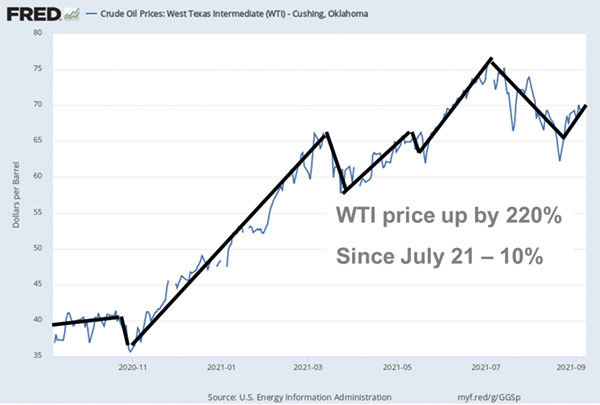

In 2021 the industry had an impressive restart, led by China and followed by other regions, particularly the USA and Europe. As a consequence, the need for energy supplies such as oil and gas ballooned, with direct implications for energy prices. The West Texas Intermediate (WTI) crude oil price boomed from November 2020 by 220%, climbing to 76 US$/barrel (Fig. 2). Experts from Goldman Sachs even forecast a crude oil price of 80-90 US$/barrel by end of 2021.

The European Brent oil price developed along the same lines.

Increased demand from Asia has also created a boom in gas prices. The demand for Liquified Petroleum Gas (LPG) especially from the USA is enormous. US LPG supplies were even rechannelled from Europe to Asia serving the high-priced demand. European gas prices have gone up by anything up to 320% in recent months. This has had a considerable effect on the number of oil and gas rigs in operation: Since the number of new oil and gas rigs itself is directly linked to the price of these commodities (Fig.2), the recent price boom means the number of oil and gas rigs has significantly increased since October 2020. In the US, the rig count as per September 17th, 2021 is 512, which is an increase of 266 rigs since September 10th, 2010 (257 rigs). In the same period, Canada increased its number of rigs by 101 from 90 to 191 rigs and internationally the number of rigs increased by 56 from 721 to 777 rigs.

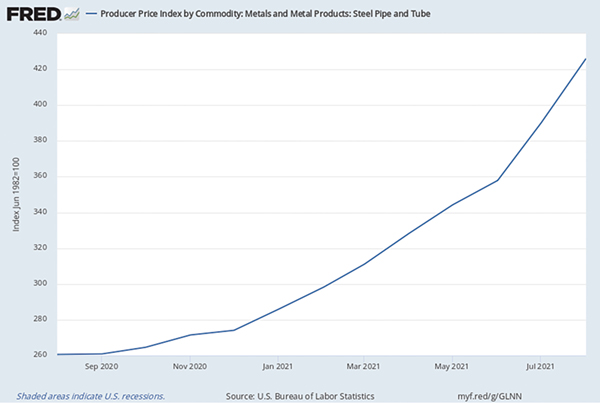

The consumption of OCTG tubes and pipes is, as shown in our previous articles, dependant on the number of rigs, as well as the depth of drilling and the capacity of the rigs. Therefore, the demand for OCTG tubes and pipes is booming as well, leading to significant price increases for our industry (Fig.3).

The big question right now is how sustainable are these high oil and gas prices and the associated high consumption of OCTG tubes and pipes? We should bear in mind that, besides the revitalisation of the industry across the world, we must also consider effects such as political intervention and speculation currently driving prices. This includes, for example, supply shortages planned by OPEC and other oil- and gas-producing countries and market speculations, which led to almost empty gas reserves in Europe, since importers were speculating on falling gas producer prices.

Either way, it’s to be assumed that as soon as the supply and demand ecosystem regains its balance, prices will calm down again, with consequences for the OCTG tube and pipe demand. In addition, line pipe projects, which were virtually non-existent in 2020, are now restarting in 2021 with related positive effects on the demand for line pipes >16”.

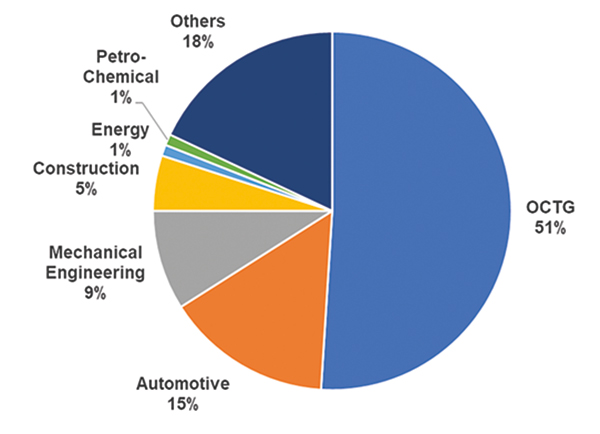

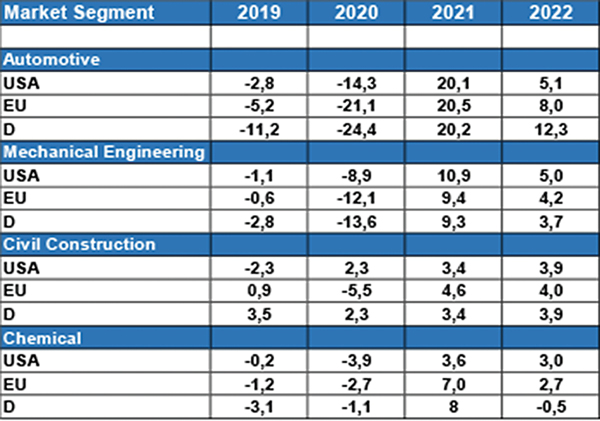

Other relevant markets for tubes and pipes (Fig.4 & 5) are not currently experiencing such spectacular volatility but are nonetheless displaying positive trends. The automotive market, after a difficult year 2020 with production cuts of about 15-25%, is now recovering in 2021 to pre-pandemic levels. 2022 is even expected to bring a revival of pre-corona growth rates (Fig.5). But major supply chain turbulences are creating a few dark clouds on the horizon. Automotive steel customers within existing annual frame contracts are for the time being reducing their volumes procured, to an extend that could affect the operation and influence the market. This September 2021 carmakers requested about 30% less steel than in typical months.

The present tendency of large automotive producers such as Ford, General Motors or VW to follow the Tesla model has prompted investments of billions of dollars in electric vehicles and digitalization of cars.

As far as suppliers in our industry are concerned, it remains to be seen how the current high prices for tubes and pipes impact the upcoming frame contract negotiations for 2022. It’s possible that price escalation clauses or shorter contract duration times may offer a solution. The market segment mechanical engineering, representing about 9% of the total tube and pipe market, lost about 12% of its volume in 2020. 2021 so far has not been able to compensate for such losses, and it’s expected that pre-pandemic levels will only be reached again in 2022. Some investments in mechanical engineering products are still delayed due to uncertainties within consequences due to the corona pandemic.

Another attractive market for tube and pipe producers is the civil construction market, representing about 5% of the world tube production. The impact of the pandemic on this market segment was much less severe in 2020. Some regions, such as the USA, managed to avoid negative growth altogether. The construction market is steadily growing along with GDP growth, and it’s expected that 2021 and 2022 will see expansion continue at a moderate level of 3-4%.

All market segments nonetheless still suffer from supply chain challenges, rising costs and reduced availability of qualified manpower. The problems in supply chains, especially from remote Far East sources, have prompted businesses and industries to buy local. Shipping costs are booming as well, and containers represent a serious bottle neck. The USA in consequence forecast an increase in local supply of about 10-12% (approx. 443 billion US$).

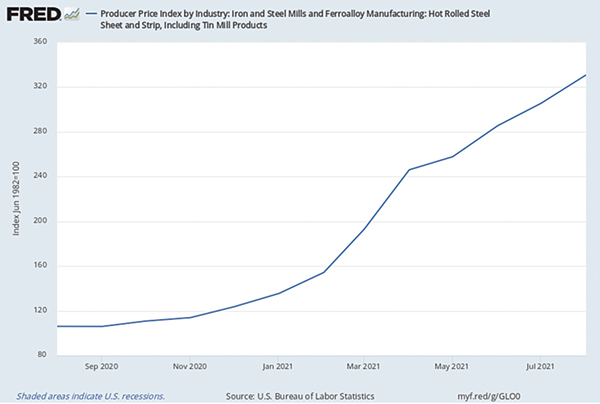

If we look at hot rolled coil prices (Fig.6), we see a major challenge for ERW pipes. Since September 2020 the prices have gone up by about 314%, from 450 US$/ton to a peak of about 1400 US$/ton in August 2021. Since then, prices have fallen again to about 1225 US$/ton in September 2021. Last week of September, prices of about 950 US$/ton were reported.

Such volatile HRC prices are extremely difficult to cope with, since price escalation clauses are uncommon in the carbon steel tube business. Price escalation clauses are mainly associated with stainless steel tube production, due to the frequent volatility of raw material costs. Some tube and pipe producers even decided to halt production due to the unmanageable raw material costs.

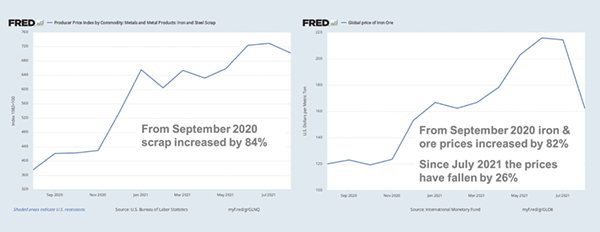

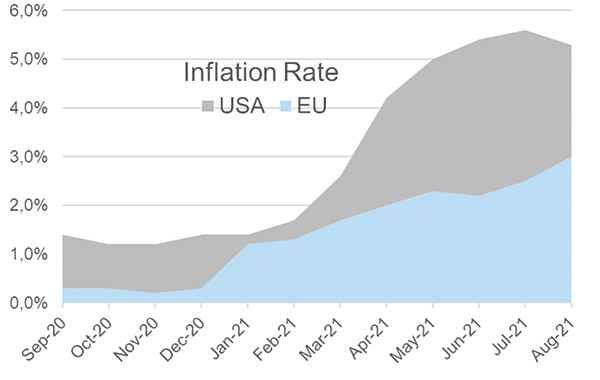

The prices for scrap and iron ore went up as well, but these prices have also begun to fall again in recent weeks (Fig.7). Driven by the prices for energy, cars and raw materials, inflation is on the rise (Fig.8). In the USA this year the inflation rate reached 5.5% (target 2%). Even if the inflation rate is adjusted for energy and food prices, as some economists like to do, the rate is still a hefty 3.8%. This is the biggest increase since June 1992. The US central bank is now even considering restricting its loose monetary policy.

Even in Europe forecasts anticipate an inflation rate over 4% by the end of 2021, driven mainly by the cost of energy. Energy costs may rise still further due to regional political interventions to prevent climate change. If these measures are not introduced in an internationally balanced way, some European regions may even risk the destruction of their high energy consuming industries to lose them to other lower-cost regions. It is common knowledge that the industry tends to settle in regions with reasonable energy costs.

Availability of qualified labour is another challenge for our industry. During the pandemic, countries adopted different approaches to protect employees from financial hardship. Some European countries kept the employees in employment, but paid compensation for short-time working so that the employers had no cost for the reduced working hours of employees (even 0% working was possible). When the workload of the companies recovered, short-time working regimes were abandoned, and the employees came back to work.

Other countries, like the USA, followed a different model to avoid financial hardship. The companies laid off employees and the unemployed got direct payment as compensation. When the industry recovered in 2021 and the workload increased, many companies were faced with difficulties re-hiring those they had fired, since they were still receiving unemployment compensation. However, with most compensation schemes winding up in September 2021, it can be expected that reemployment will improve, and with it, the availability of qualified labour.

In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked in August/September this year. Energy costs, however, may remain high or even climb further if market interventions (e.g. OPEC plus) or political measures to prevent climate change are not introduced in a balanced way. This effect may also push inflation rates still higher, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry can be restored, price volatility can be expected to calm down.

All these steel tube and pipe markets can be subdivided into commodity volume markets and the market segments with high-tech requirements. For high-tech requirements, the decisive factors are the steel quality and the tube plant infrastructure. The steel quality for many high-tech steel tube and pipe applications is demanding with regard to chemistry and homogeneity. The availability of such steel qualities, with the relevant uniformity and quantities for welded tubes and pipes, as steel strip and plates or as billets for seamless tubes and pipes is limited, sometimes creating a significant hurdle for the supply of tubes and pipes into such high-tech markets.

On the other hand, tube plant infrastructure with respect to tube mills and finishing lines as well as applied quality assurance systems also plays a significant role. Growing importance can be attributed to agile management strategies regarding customer benefit, process and product quality enhancement by applying “Industry 4.0” measures.

With an eye to the return to something like normal, it should be noted that plant builders and technology suppliers alike may find interesting business opportunities in this new market segment. Some technology suppliers have already reacted and enhanced their product portfolio with the addition of digital solutions. Some interesting applications of “Industry 4.0” in the tube and pipe industry were presented by various companies at the ITA netForum 2020 which was organized to substitute the cancelled TUBE 2020 in Düsseldorf. It is good to realize, that besides the virtual exchange in our industry, such as the webinars organized by the International Tube Association (ITA) now again hybrid or even personal events for industrial exchange take place. Increasing interest for technological exchange for the tube and pipe industry for example was identified during the well-attended FABTECH exhibition in Chicago/USA this September 2021.

We are looking forward meeting tube producers as well as suppliers to the tube and pipe industry at our leading industrial exhibition, the Tube Düsseldorf in May 2022.

Dr. Gunther Voswinckel

After a disastrous 2020, characterized by shrinking market demand, some tube and pipe producers closed their production facilities. By contrast, 2021 has been defined by increased demand, followed by an enormous price and cost rally combined with deficits in the supply chains. It would seem that the price and cost surges peaked this fall 2021, although supply chains, energy costs and the sourcing of qualified labour still present challenges. However, the market in principle provides enough tube and pipe producing capacity to serve the demand, and so will likely calm down as soon as demand and supply can be balanced again.

Still, energy costs will remain challenging for high energy consuming industries like the steel tube and pipe industry. Strategic measures for our industry are consequently quite demanding. Lean and agile organizations with flexible, customer-orientated production facilities are the best answer to demanding and volatile market requirements. Agile digital solutions in the spirit of “Industry 4.0” offer further opportunities to stay successful.

The International Tube Association organized several well attended webinars in 2020 and 2021 as well as the virtual fair ITA netForum 2020 to substitute the cancelled TUBE Düsseldorf 2020 to keep the exchange of our industry ongoing. This September 2021 new technologies were successfully presented at the FABTECH exhibition in Chicago. The ITA was also present with a booth to serve its members.

We are also looking forward for great exchange of our industry at our world largest tube and pipe show “Tube Düsseldorf” in May 2022. The year 2020 was disastrous for the tube and pipe industry. World tube production fell by 15% (Fig.1), with the USA (-24%) and Japan (-21%) the worst hit. The smallest decline was reported for seamless pipes at -10%. Much higher production cutbacks were reported for welded pipes >16”, with losses of up to 27%. Line pipe projects were postponed or stopped altogether, due to the pandemic.

Many supply chains were disrupted and in consequence some production facilities were shut down. Pipe and tube prices went down by 4% in the first 3 quarters of 2020, stabilizing in the 4th quarter 2020 due to an increase in tube and pipe demand.

In 2021 the industry had an impressive restart, led by China and followed by other regions, particularly the USA and Europe. As a consequence, the need for energy supplies such as oil and gas ballooned, with direct implications for energy prices. The West Texas Intermediate (WTI) crude oil price boomed from November 2020 by 220%, climbing to 76 US$/barrel (Fig. 2). Experts from Goldman Sachs even forecast a crude oil price of 80-90 US$/barrel by end of 2021.

The European Brent oil price developed along the same lines.

Increased demand from Asia has also created a boom in gas prices. The demand for Liquified Petroleum Gas (LPG) especially from the USA is enormous. US LPG supplies were even rechannelled from Europe to Asia serving the high-priced demand. European gas prices have gone up by anything up to 320% in recent months. This has had a considerable effect on the number of oil and gas rigs in operation: Since the number of new oil and gas rigs itself is directly linked to the price of these commodities (Fig.2), the recent price boom means the number of oil and gas rigs has significantly increased since October 2020. In the US, the rig count as per September 17th, 2021 is 512, which is an increase of 266 rigs since September 10th, 2010 (257 rigs). In the same period, Canada increased its number of rigs by 101 from 90 to 191 rigs and internationally the number of rigs increased by 56 from 721 to 777 rigs.

The consumption of OCTG tubes and pipes is, as shown in our previous articles, dependant on the number of rigs, as well as the depth of drilling and the capacity of the rigs. Therefore, the demand for OCTG tubes and pipes is booming as well, leading to significant price increases for our industry (Fig.3).

The big question right now is how sustainable are these high oil and gas prices and the associated high consumption of OCTG tubes and pipes? We should bear in mind that, besides the revitalisation of the industry across the world, we must also consider effects such as political intervention and speculation currently driving prices. This includes, for example, supply shortages planned by OPEC and other oil- and gas-producing countries and market speculations, which led to almost empty gas reserves in Europe, since importers were speculating on falling gas producer prices.

Either way, it’s to be assumed that as soon as the supply and demand ecosystem regains its balance, prices will calm down again, with consequences for the OCTG tube and pipe demand. In addition, line pipe projects, which were virtually non-existent in 2020, are now restarting in 2021 with related positive effects on the demand for line pipes >16”.

Other relevant markets for tubes and pipes (Fig.4 & 5) are not currently experiencing such spectacular volatility but are nonetheless displaying positive trends. The automotive market, after a difficult year 2020 with production cuts of about 15-25%, is now recovering in 2021 to pre-pandemic levels. 2022 is even expected to bring a revival of pre-corona growth rates (Fig.5). But major supply chain turbulences are creating a few dark clouds on the horizon. Automotive steel customers within existing annual frame contracts are for the time being reducing their volumes procured, to an extend that could affect the operation and influence the market. This September 2021 carmakers requested about 30% less steel than in typical months.

The present tendency of large automotive producers such as Ford, General Motors or VW to follow the Tesla model has prompted investments of billions of dollars in electric vehicles and digitalization of cars.

As far as suppliers in our industry are concerned, it remains to be seen how the current high prices for tubes and pipes impact the upcoming frame contract negotiations for 2022. It’s possible that price escalation clauses or shorter contract duration times may offer a solution. The market segment mechanical engineering, representing about 9% of the total tube and pipe market, lost about 12% of its volume in 2020. 2021 so far has not been able to compensate for such losses, and it’s expected that pre-pandemic levels will only be reached again in 2022. Some investments in mechanical engineering products are still delayed due to uncertainties within consequences due to the corona pandemic.

Another attractive market for tube and pipe producers is the civil construction market, representing about 5% of the world tube production. The impact of the pandemic on this market segment was much less severe in 2020. Some regions, such as the USA, managed to avoid negative growth altogether. The construction market is steadily growing along with GDP growth, and it’s expected that 2021 and 2022 will see expansion continue at a moderate level of 3-4%.

All market segments nonetheless still suffer from supply chain challenges, rising costs and reduced availability of qualified manpower. The problems in supply chains, especially from remote Far East sources, have prompted businesses and industries to buy local. Shipping costs are booming as well, and containers represent a serious bottle neck. The USA in consequence forecast an increase in local supply of about 10-12% (approx. 443 billion US$).

If we look at hot rolled coil prices (Fig.6), we see a major challenge for ERW pipes. Since September 2020 the prices have gone up by about 314%, from 450 US$/ton to a peak of about 1400 US$/ton in August 2021. Since then, prices have fallen again to about 1225 US$/ton in September 2021. Last week of September, prices of about 950 US$/ton were reported.

Such volatile HRC prices are extremely difficult to cope with, since price escalation clauses are uncommon in the carbon steel tube business. Price escalation clauses are mainly associated with stainless steel tube production, due to the frequent volatility of raw material costs. Some tube and pipe producers even decided to halt production due to the unmanageable raw material costs.

The prices for scrap and iron ore went up as well, but these prices have also begun to fall again in recent weeks (Fig.7). Driven by the prices for energy, cars and raw materials, inflation is on the rise (Fig.8). In the USA this year the inflation rate reached 5.5% (target 2%). Even if the inflation rate is adjusted for energy and food prices, as some economists like to do, the rate is still a hefty 3.8%. This is the biggest increase since June 1992. The US central bank is now even considering restricting its loose monetary policy.

Even in Europe forecasts anticipate an inflation rate over 4% by the end of 2021, driven mainly by the cost of energy. Energy costs may rise still further due to regional political interventions to prevent climate change. If these measures are not introduced in an internationally balanced way, some European regions may even risk the destruction of their high energy consuming industries to lose them to other lower-cost regions. It is common knowledge that the industry tends to settle in regions with reasonable energy costs.

Availability of qualified labour is another challenge for our industry. During the pandemic, countries adopted different approaches to protect employees from financial hardship. Some European countries kept the employees in employment, but paid compensation for short-time working so that the employers had no cost for the reduced working hours of employees (even 0% working was possible). When the workload of the companies recovered, short-time working regimes were abandoned, and the employees came back to work.

Other countries, like the USA, followed a different model to avoid financial hardship. The companies laid off employees and the unemployed got direct payment as compensation. When the industry recovered in 2021 and the workload increased, many companies were faced with difficulties re-hiring those they had fired, since they were still receiving unemployment compensation. However, with most compensation schemes winding up in September 2021, it can be expected that reemployment will improve, and with it, the availability of qualified labour.

In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked in August/September this year. Energy costs, however, may remain high or even climb further if market interventions (e.g. OPEC plus) or political measures to prevent climate change are not introduced in a balanced way. This effect may also push inflation rates still higher, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry can be restored, price volatility can be expected to calm down.

All these steel tube and pipe markets can be subdivided into commodity volume markets and the market segments with high-tech requirements. For high-tech requirements, the decisive factors are the steel quality and the tube plant infrastructure. The steel quality for many high-tech steel tube and pipe applications is demanding with regard to chemistry and homogeneity. The availability of such steel qualities, with the relevant uniformity and quantities for welded tubes and pipes, as steel strip and plates or as billets for seamless tubes and pipes is limited, sometimes creating a significant hurdle for the supply of tubes and pipes into such high-tech markets.

On the other hand, tube plant infrastructure with respect to tube mills and finishing lines as well as applied quality assurance systems also plays a significant role. Growing importance can be attributed to agile management strategies regarding customer benefit, process and product quality enhancement by applying “Industry 4.0” measures.

With an eye to the return to something like normal, it should be noted that plant builders and technology suppliers alike may find interesting business opportunities in this new market segment. Some technology suppliers have already reacted and enhanced their product portfolio with the addition of digital solutions. Some interesting applications of “Industry 4.0” in the tube and pipe industry were presented by various companies at the ITA netForum 2020 which was organized to substitute the cancelled TUBE 2020 in Düsseldorf. It is good to realize, that besides the virtual exchange in our industry, such as the webinars organized by the International Tube Association (ITA) now again hybrid or even personal events for industrial exchange take place. Increasing interest for technological exchange for the tube and pipe industry for example was identified during the well-attended FABTECH exhibition in Chicago/USA this September 2021.

We are looking forward meeting tube producers as well as suppliers to the tube and pipe industry at our leading industrial exhibition, the Tube Düsseldorf in May 2022.

Dr. Gunther Voswinckel