Market Overview

Have a look ...World Tube & Pipe Market – some influencing factors on the present situation

Dr. Gunther Voswinckel, VOSCO GmbH – Update as per April 2020

This column/article, in a consecutive way, discusses several economic consequences for the tube and pipe industry. These last weeks have really caused unforeseen consequences to the world. The corona pandemic starting in Asia, mainly in Wuhan and the Hubei province, has meanwhile took control of Europe, the USA, and many other countries. It is even very likely that we will experience the corona roll out throughout the entire world. In consequence many countries have already limited some substantial human rights, such as the freedom of movement as well as the freedom of property and the freedom of practicing an occupation. Many countries have decided to lock down major parts of the public, industrial and private activities to protect human lives. In this article I will not discuss the sad and disastrous consequences for the mankind (as of 21. April 2020 worldwide ab. 2,5 Mio. known persons in 185 countries are infected by Covid-19 and about 165.000 persons have died being infected by Covid-19). The latest epicentre being the USA with 790.000 infected persons and 42.200 killed persons. The comments on the human consequences of this sad catastrophe shall be made by analysts who are mor experts in this field.

In the following I will only concentrate on the fast-developing consequences for the tube and pipe industry. Many countries have decided to lock down major parts of the industry. Consequently, major supply and service chains are not working any more. It will take quite some time to recover the well-established globalized production network. In the meantime, the consumption of energy and most industrial goods has fallen apart.

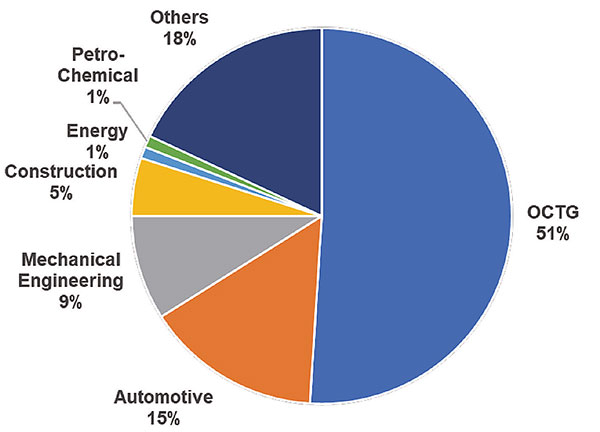

The by far largest market segment for tubes and pipes is the OCTG (Oil Country Tubular Goods) market. With about 51 % of the world tube and pipe market share it is largely dependent on the oil and gas price, which still can be considered as the blood line of industrialisation. The daily consumption has reached a peak value of about 100 Mio. barrel/day early 2020. Since the corona pandemic started in China, the world oil consumption dropped by more than 30%. A tremendous oversupply of oil was the consequence immediately reflected in an oil price drop of about 60% (60 US$/Barrel to 25 US$/barrel in only 5 weeks). The OPEC lead by Saudi Arabia, and major non-OPEC oil producing countries tried to find international agreements to reduce the daily oil production. But due to the significant implications of such measures to some countries first attempts for an agreement failed. Subsequent internal conflicts between the oil producing countries even put further pressure on the oil price level. Only on April 20th the oil producing countries could agree to reduce the world daily production by about 10 million barrel/day for the months May and June. This reduction of the daily production anyhow did not show the desired consequences, since even this reduced production level is by far higher than the present world oil demand caused by the lock down due the corona pandemic. Unless the world oil demand will raise again or the oil producing countries can agree on further significant reductions on the oil production, the oil price will probably remain on such low level.

Due to the crash of the oil price, the world drilling activities are significantly reduced having negative impact on the tube and pipe industry. The tube and pipe industry is partially still covered by long-term delivery contracts, anyhow it can be expected, that the renewal of such delivery contracts will be challenging for the tube and pipe industry. Other tube and pipe markets such as the automotive (15%) and the mechanical engineering (9%) are also significantly hurt by the industrial shut down caused by the corona pandemic. Many automotive production plants and mechanical equipment plants around the world were shut down during April 2020. Even the world car sales volume collapsed by about 70% this month. Now since China and some other countries are restarting its production facilities, there is hope for a fast recovery within 2020.

The mechanical engineering market with its uncounted applications represents many interesting segments for the tube and pipe industry, such as e.g. hydraulic cylinder tubes or ball bearing tubes. It can be expected that the investment in capital goods will slow down and be postponed to secure companies assets, anyhow the market will recover and may even become stronger like we have seen after the last financial crises. The building and construction industry (5%) also represent an attractive market segment for our industry. The building and construction industry market is growing by about 4%/year. If the recession caused by the corona pandemic does not last long, this market may even be spared and not so negatively hurt. In this market we can see a competition between steel/tube structures and concrete elements. Lobbying activities are required, especially to further enlarge the steel/tube penetration for skyscrapers and bridges.

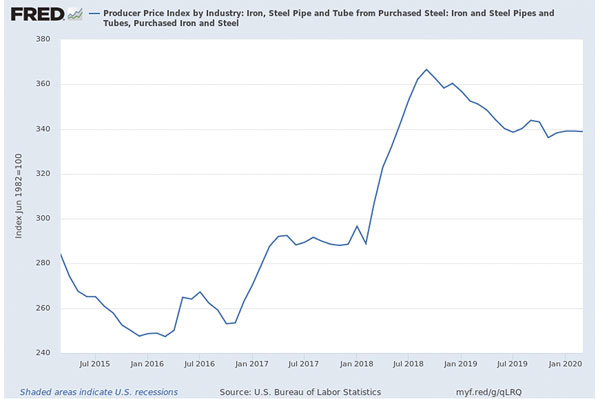

The tube and pipe price index weakened since September 2018 from 367 down to 339 in March 2020 (-8%). April figures are not yet published, anyhow it can be expected that tube and pipe prices will drop even more significantly. In the high wage countries, demanding high-tech products are strategic targets rather than commodity-grade tubes and pipes. Limiting factors are sometimes the availability of steel quality and quantity for strip, plate and billets as well as the tube plant infrastructure regarding machines and the applied quality standards.

Anyhow the still unpredictable consequences of the worldwide corona pandemic, the trade conflict between the USA and China, the instable political situation in many countries are creating an atmosphere that put pressure on our industry with great danger for a global economic recession.

Strategical measures for our industry are consequently quite demanding. Lean and agile organizations with flexible and customer orientated production facilities are adequate to prompt the demanding and volatile market requirements. Agile digital solutions in the sense of “Industry 4.0” offer further opportunities to stay successful.

In this column/article I would like to discuss some important segments of the tube and pipe market. These last weeks have really caused unforeseen consequences to the world. The corona pandemic starting in Asia, mainly in Wuhan and the Hubei province early February 2020, has meanwhile took control of Europe, the USA, and many other countries. It is even very likely that we will experience the corona roll out throughout the entire world. In consequence many countries have limited some substantial human rights, such as the freedom of movement as well as the freedom of property and the freedom of practicing an occupation. Many countries have decided to lock down major parts of the public, industrial and private activities to protect human lives. In this article I will not discuss the sad and disastrous consequences for the mankind (as of 21. April 2020 worldwide ab. 2,5 Mio. known persons in 185 countries are infected by Covid-19 and about 165.000 persons have died being infected by Covid-19). The latest epicentre being the USA with most infected (790.000) and killed persons (42.200). The comments on the human consequences of this sad catastrophe shall be made by analysts who are more expert in this field.

In the following will only concentrate on the consequences for the tube and pipe industry.

Many countries have decided to lock down major parts of the industry. The international stock markets are flooded with huge amounts of financial support to avoid bankruptcy or unfriendly take overs. Some countries are trying to compensate the corona consequences with financial support also for mid-size and small entities. Major supply and service chains are not working any more. It will take quite some time to recover the well-established globalized production network. In the meantime, the consumption of energy and industrial goods has fallen apart. The tube and pipe industry, unless still protected by long-term delivery contracts is also hard hit by this global pandemic. The by far largest market segment for tubes and pipes is the OCTG (Oil Country Tubular Goods) industry with 51% market share (Figure 1).

The OCTG market is subdivided in pipes used for oil and gas exploration rigs, such as drill pipes, joints, tubing and casings and further downstream line pipes to transport oil and gas.

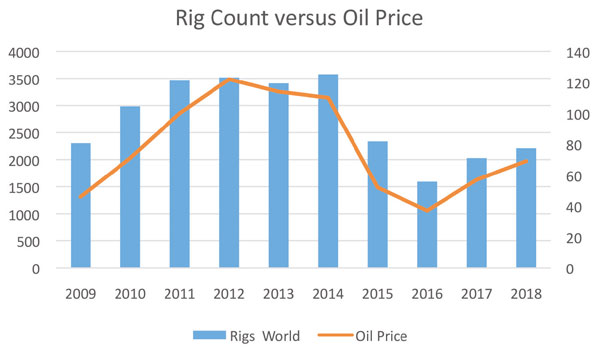

The OCTG tube and pipe consumption is heavily depending on the number of rigs, as well as the depth of drilling and the capacity of the rigs. The number of new oil and gas rigs itself is heavily depending on the oil price (Figure 2).

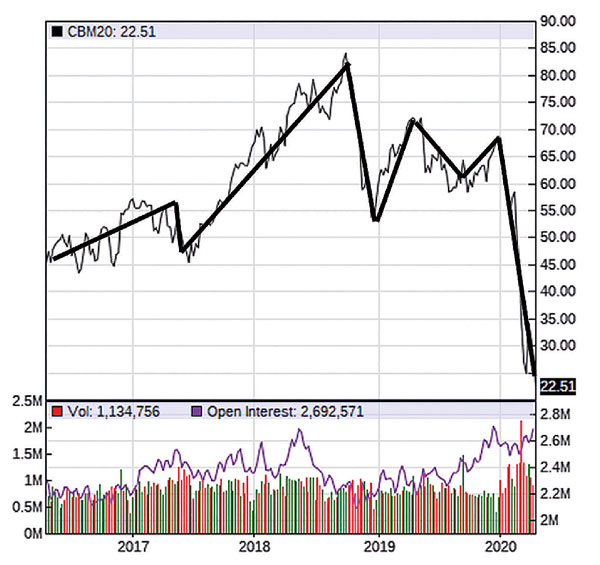

The oil price chart of North Sea Brent Oil (Figure 3) shows, after a long period of raising oil prices from early 2016 (41 US$/barrel) to October 2018 (85 US$/barrel), the crude oil price fell down to 53 US$/barrel in only 2 months, to recover to about 72 US$/barrel until April 2019. Since April 2019 to January 2020 the oil price fluctuated between 60 US$/barrel to 68 US$/barrel. These developments were mainly determined by political interventions e.g. in form of imposing trade embargos on oil producing countries like Iran and Venezuela to balance demand and offerings of oil. End of January 2020, the first corona infections were reported from Wuhan/China, and the Chinese government took first countermeasures and shut down parts of social life and their industry. Other countries followed with such measures afterwards. These measures were prompted by a world oil consumption decrease of more than 30% (from about 100 Mio. barrel/day to only 70 Mio. barrel/day). A tremendous oversupply of oil occurred reflected in a crude oil price collapse of about 60% (64 US$/Barrel to 25 US$/barrel in only 5 weeks). The OPEC lead by Saudi Arabia, and major non-OPEC oil producing countries tried to find international agreements to reduce the daily oil production. But due to the significant implications of such measures to some countries first attempts for an agreement failed. Subsequent internal conflicts between the oil producing countries even put further pressure on the oil price level. Only on April 20th the oil producing countries could agree to reduce the world daily production by about 10 Mio. barrel/day for the months May and June 2020. This announcement to reduce the daily production anyhow did not show the desired consequences, since even this reduced production level is by far higher than the present world oil demand caused by industrial lock down due the corona pandemic. The International Energy Agency (IEA) expects, if the industry restarts within May 2020, an overall oil consumption reduction for 2020 of about 9 Mio. barrel/day for the entire year. This may be optimistic, anyhow the agreement of 20th of April by far does not outbalance the reduced demand for crude oil in the present months March and April. Therefore, the crude oil price continued its free fall to 18 US$/barrel as of 19th of April. Unless the world oil demand will raise again or the oil producing countries can agree on further significant reductions on the oil production, the oil price will probably remain on such low level.

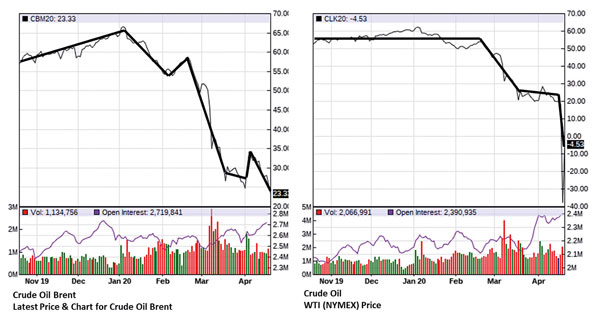

The two charts (Figure 4) show the US WTI (West Texas Intermediate) and the European Brent (North Sea Oil) for the last 6 months. Normally the price level of these two dominating brands are quite concurrent. Right now, since the corona pandemic let the oil demand fall apart, the situation seems to get out of balance.

The WTI oil prices has lost by far more compared to the Brent price. WTI is to a great extend subject to trading with futures. The US based oil storage capacities, e.g. at the central US handling location Cushing/Oklahoma, are full and cannot store more oil. Another about 160 Mio. barrel of oil is on its way in tankers swimming on the ocean. The May futures become due; the collapsed market does not take the oil; the oil must be physically taken, unless the oil can be stored by the owner of the future. Therefore the owner of the May oil futures sold at any price. Resulting in a situation that the WTI oil price noted on the 21st of April 2020 at – 37 US$. First time ever the traders had to pay to get rid of their oil!

The European North Sea Brent oil, at the same time noted at about 20 US$/barrel also very low but was not so severely hit by speculation.

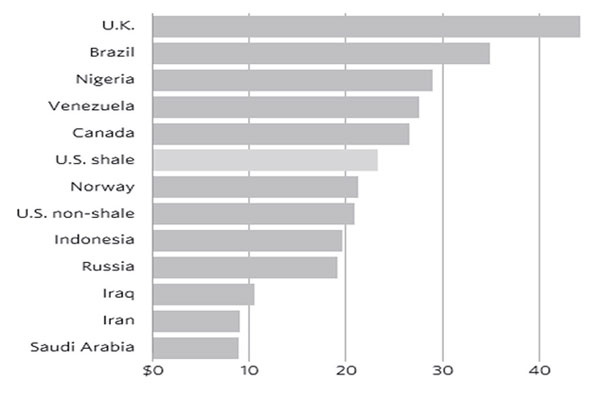

Considering the cost of the different countries to produce and pump oil and gas (Figure 5) it becomes obvious how critical it is if the oil prices crashes down to levels, we have seen this April 2020. Considering the cost of the different countries to produce and pump oil and gas (Figure 5) it becomes obvious how critical it is if the oil prices crashes down to levels, we have seen this April 2020.

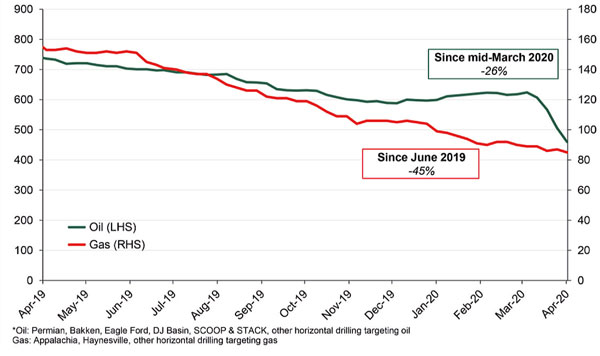

The oil exploration industry stops its drilling activities at such low oil prices. The USA for example, who became, due to its fracking boom, the largest oil and gas producing country in the world, reduced its horizontal drilling activities by about 26% since March 2020 (Figure 6). The cost to produce US fracking oil is much higher than the present market price. Many analysts even expect bankruptcies of such companies who produce oil at higher prices. At the same time, the storages for OCTG tubes and pipes are filling up causing order volumes and prices sliding down for the tube and pipe industry.

To stimulate the oil market the US president Mr. Trump announced on April 21st to increase the oil demand by enlarging the national oil reserve volume.

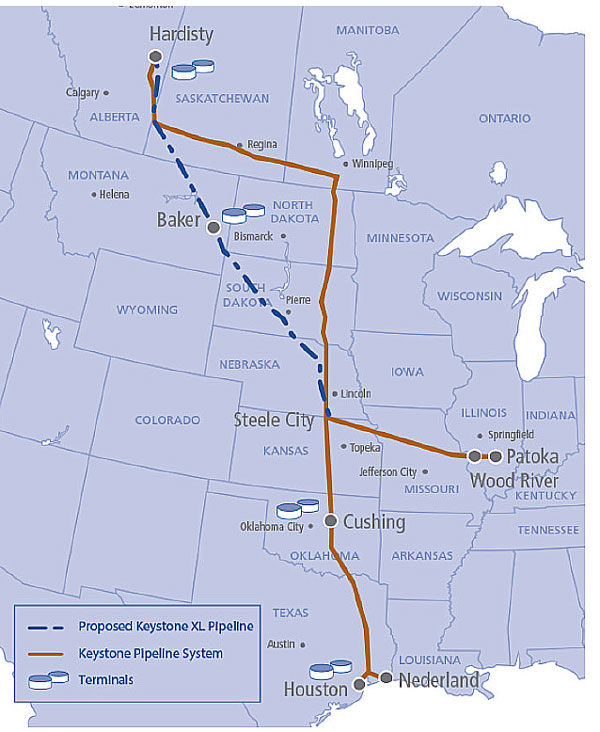

The second oil and gas market represent gas and oil pipelines. The pipeline market is a project-based business with long planning periods and high political determinations. Most of such projects are not yet so much affected by the corona pandemic if the relevant global supply chains are working. Pipeline projects are planned in e.g. Europe, USA and Asia. In Europe gas pipelines are mainly built to serve gas from gas and oil fields in Russia and in the North Sea. In the USA the new Keystone XL pipeline is planned to transport oil from Canada to the petrochemical centres in the US. In Asia they shall serve the new petrochemical complexes in Malaysia and Indonesia. All these projects are intensively discussed on political and environmental platforms. The European project “Nord Stream” is a good example, since the US president Mr. Trump and the Polish government are using all their influence to ban this project (Figure 7).

The US government has even imposed trade sanctions on the involved international companies. Although the US oil and gas exports to the EU have been raising significantly, the US government want to ban competition from Russia. - Poland on the other had want to secure its income related to oil and gas being transported through pipelines on their territory. On the other hand, the US pipeline project “Keystone XL” (Figure 8) is supported by Mr. Trump but environmental activists are fighting hard against the project. Due to such interventions is becomes more and more difficult to predict pipeline project developments in the oil and gas business. Therefore, also this market can be considered as difficult in regards of strategical forecasts, which is reflected in the volatile regional production figures of pipeline pipes. If we now take a look at the price level of steel tube and pipes as published by FRED, the US bureau of labor statistics (Figure 9), we can see that the tube and pipe price index since September 2018 weakened from 367 down to 339 in March 2020 (-8%). April figures are not yet published, anyhow it can be expected that tube and pipe prices will drop even more significant.

Besides OCTG, as dominating market, the automotive (15%), mechanical engineering (9%) and construction industry (5%) are also strong market segments for the steel tube and pipe suppliers. The second important market with a market share of 15% is the automotive market. Tubes and pipes with diameters up to 90 mm are mainly applied.

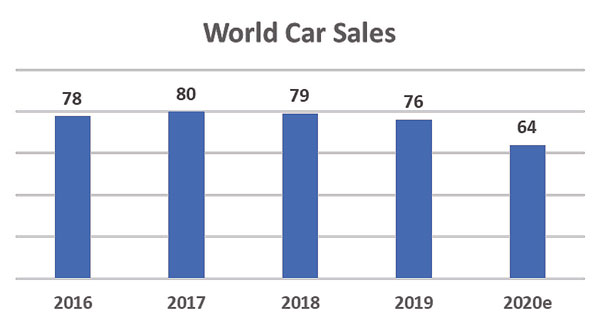

Since 2017, after many years of stable growth, the annual world car sales figure was declining 2018 (-1%) and 2019 (- 4%). 2020e due to the corona pandemic is expected to materialize another significant decline (-16%) of the world car sales (Figure 10).

The automotive industry is characterized by very global supply chain systems, demanding by its just in time deliveries. The car sales figures 2020 dramatically fell apart (e.g. China minus 82% this February) and many OEM and supplier’s production plants were shut down. This April 2020 the world automotive industry is almost totally shut down. Some suppliers report production levels in April and May 2020 of only 20% to 30% of the originally planned production figures. Starting with the Chinese production plants, now also some European and other countries are planning to restart production in May 2020. Anyhow many countries, due to the ongoing corona pandemic, still will not be able to restart its industries. Therefore, it will be a great challenge to restart the complex global supply chains in a reliable way.

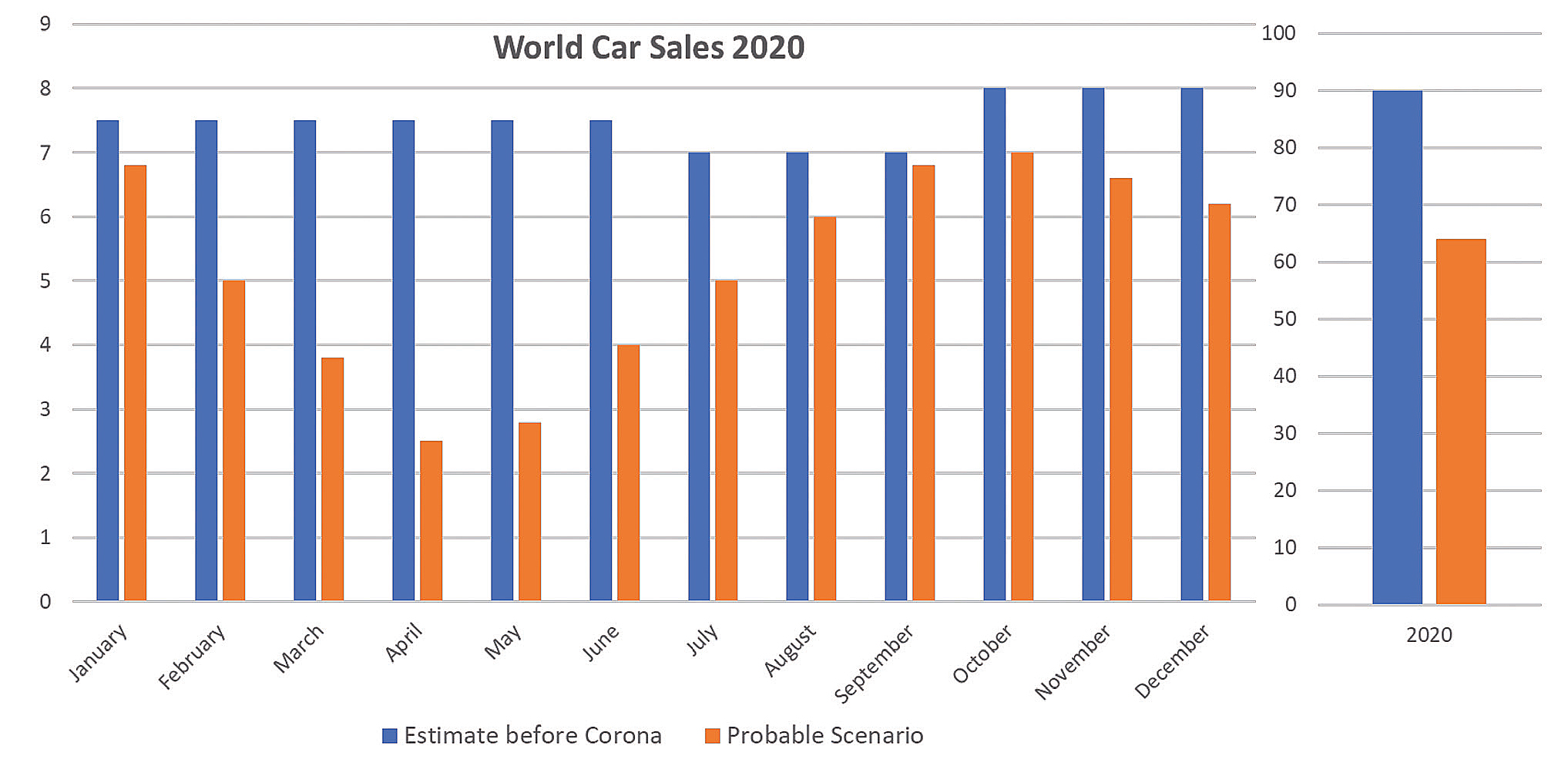

Analysts from various well reputed organisations show impressively (Figure 11) how they anticipate the world car sales development throughout 2020. This so called probable scenario was established under the condition that the automotive industry will reliably restart in May 2020 without further delays due to the corona epidemic. It is assumed, that after the dramatic cutbacks in April and May (ab. 70% of original values), the sales volumes will rapidly recover until September 2020.

The tube and pipe industry supplying the automotive industry faces even more challenges if the ramp up would not perform as steep as stipulated in this study. The industry is used to large production lot sizes which will significantly melt down if the ramp up curve would be flatter. In such a case the industry may even not reach minimum critical lot sizes.

The market of mechanical engineering for tubes and pipes, representing 9% of the total tube and pipe market, is quite diversified due to its uncounted applications. The impact due to the corona epidemic will be different for many products. Assuming most companies will postpone any possible capital investment to secure the assets, the demand for tubes and pipes will consequently be reduced as well. The pressure on tube and pipe producers serving this market on production flexibility and efficiency will even further increase over and above the present, already demanding, level.

Another attractive market for tube and pipe producers is the construction market, representing about 5% of the world tube production. The construction market is steadily growing along with the GDP growth. There is some hope, if the world recession would be only of a short duration, as stipulated by many analysts, the construction market and its suppliers would experience only smaller impacts due to the corona epidemic. The growth potential of the construction market is quite impressive (Figure 12).

Another report recently released, Global Construction 2030, forecasts the volume of construction output will grow by 85% to 15.5 trillion worldwide by 2030, with three countries, China, USA and India, leading the way and accounting for 57% of the global growth. The benchmark global study from Global Construction Perspectives and Oxford Economics, show average global construction growth of 3,9%/year to 2030, outpacing that of global GDP by over 1 percentage point, driven by developed countries recovering from economic instability and emerging countries to industrialize. The construction market in India will grow almost twice as fast as China to 2030, providing a new engine of growth in emerging markets. India´s urban population is expected to grow by a another 165 million by 2030, swelling Delhi by further 10,4 million people to become the world´s second largest city. Due to this market potential the Indian chapter of the ITA has just organized a well-attended and most recognized conference in Mumbai regarding the structural applications for tubes and pipes.

When it comes to Europe, whilst it won´t recover to reach pre-crisis levels until 2025, the UK is a growth market, overtaking Germany to become the largest in Europe and the world´s sixth largest construction market by 2030. The mayor market applications for tubes and pipes in the construction market are buildings as e.g. skyscrapers, bridges and load bearing applications. Here we find a significant competition between steel/tube structures and on the other side concrete elements. For skyscrapers the trend in emerging countries to build high-rise towers is supporting the application of steel/tube structures. An outstanding advantage of steel/tube structures are applications for buildings with seismic requirements and/or dynamic loads as applied to bridges.

The success of tube and pipe applications in this mayor segments of the construction market, anyhow require intensified lobbying efforts of the tube and pipe producing industry to further convince regulation authorities and project stake holders about the advantages of steel/tube structures as cost effective, aesthetic and sustainable alternatives to concrete elements. All these steel tube and pipe markets can be subdivided in commodity volume markets and the market part with high-tech requirements. For the high-tech requirements, the decisive factors are the steel quality and the tube plant infrastructure. The steel quality for many high-tech steel tube and pipe applications is demanding regarding chemistry and homogeneity. The availability of such steel qualities with the relevant uniformity and quantities for welded tubes and pipes as steel strip and plates as well as billets for seamless tubes and pipes is limited and creates sometimes a significant hurdle to supply tubes and pipes into such high-tech markets. On the other hand, the tube plant infrastructure regarding tube mills, finishing lines as well as applied quality assurance systems have also a significant importance. Growing importance can be seen in agile management strategies regarding customer benefit, process and product quality enhancement by applying “Industry 4.0” measures. Some interesting applications of “Industry 4.0” in the tube and pipe industry were presented by various speakers at the trend setting ITA tube conference in Düsseldorf 2019.

Plant builders as technology suppliers may find interesting business opportunities in this new market segment. Some technology suppliers have already reacted and complimented their product portfolio by digital solutions.

Dr. Gunther Voswinckel

In the following I will only concentrate on the fast-developing consequences for the tube and pipe industry. Many countries have decided to lock down major parts of the industry. Consequently, major supply and service chains are not working any more. It will take quite some time to recover the well-established globalized production network. In the meantime, the consumption of energy and most industrial goods has fallen apart.

The by far largest market segment for tubes and pipes is the OCTG (Oil Country Tubular Goods) market. With about 51 % of the world tube and pipe market share it is largely dependent on the oil and gas price, which still can be considered as the blood line of industrialisation. The daily consumption has reached a peak value of about 100 Mio. barrel/day early 2020. Since the corona pandemic started in China, the world oil consumption dropped by more than 30%. A tremendous oversupply of oil was the consequence immediately reflected in an oil price drop of about 60% (60 US$/Barrel to 25 US$/barrel in only 5 weeks). The OPEC lead by Saudi Arabia, and major non-OPEC oil producing countries tried to find international agreements to reduce the daily oil production. But due to the significant implications of such measures to some countries first attempts for an agreement failed. Subsequent internal conflicts between the oil producing countries even put further pressure on the oil price level. Only on April 20th the oil producing countries could agree to reduce the world daily production by about 10 million barrel/day for the months May and June. This reduction of the daily production anyhow did not show the desired consequences, since even this reduced production level is by far higher than the present world oil demand caused by the lock down due the corona pandemic. Unless the world oil demand will raise again or the oil producing countries can agree on further significant reductions on the oil production, the oil price will probably remain on such low level.

Due to the crash of the oil price, the world drilling activities are significantly reduced having negative impact on the tube and pipe industry. The tube and pipe industry is partially still covered by long-term delivery contracts, anyhow it can be expected, that the renewal of such delivery contracts will be challenging for the tube and pipe industry. Other tube and pipe markets such as the automotive (15%) and the mechanical engineering (9%) are also significantly hurt by the industrial shut down caused by the corona pandemic. Many automotive production plants and mechanical equipment plants around the world were shut down during April 2020. Even the world car sales volume collapsed by about 70% this month. Now since China and some other countries are restarting its production facilities, there is hope for a fast recovery within 2020.

The mechanical engineering market with its uncounted applications represents many interesting segments for the tube and pipe industry, such as e.g. hydraulic cylinder tubes or ball bearing tubes. It can be expected that the investment in capital goods will slow down and be postponed to secure companies assets, anyhow the market will recover and may even become stronger like we have seen after the last financial crises. The building and construction industry (5%) also represent an attractive market segment for our industry. The building and construction industry market is growing by about 4%/year. If the recession caused by the corona pandemic does not last long, this market may even be spared and not so negatively hurt. In this market we can see a competition between steel/tube structures and concrete elements. Lobbying activities are required, especially to further enlarge the steel/tube penetration for skyscrapers and bridges.

The tube and pipe price index weakened since September 2018 from 367 down to 339 in March 2020 (-8%). April figures are not yet published, anyhow it can be expected that tube and pipe prices will drop even more significantly. In the high wage countries, demanding high-tech products are strategic targets rather than commodity-grade tubes and pipes. Limiting factors are sometimes the availability of steel quality and quantity for strip, plate and billets as well as the tube plant infrastructure regarding machines and the applied quality standards.

Anyhow the still unpredictable consequences of the worldwide corona pandemic, the trade conflict between the USA and China, the instable political situation in many countries are creating an atmosphere that put pressure on our industry with great danger for a global economic recession.

Strategical measures for our industry are consequently quite demanding. Lean and agile organizations with flexible and customer orientated production facilities are adequate to prompt the demanding and volatile market requirements. Agile digital solutions in the sense of “Industry 4.0” offer further opportunities to stay successful.

In this column/article I would like to discuss some important segments of the tube and pipe market. These last weeks have really caused unforeseen consequences to the world. The corona pandemic starting in Asia, mainly in Wuhan and the Hubei province early February 2020, has meanwhile took control of Europe, the USA, and many other countries. It is even very likely that we will experience the corona roll out throughout the entire world. In consequence many countries have limited some substantial human rights, such as the freedom of movement as well as the freedom of property and the freedom of practicing an occupation. Many countries have decided to lock down major parts of the public, industrial and private activities to protect human lives. In this article I will not discuss the sad and disastrous consequences for the mankind (as of 21. April 2020 worldwide ab. 2,5 Mio. known persons in 185 countries are infected by Covid-19 and about 165.000 persons have died being infected by Covid-19). The latest epicentre being the USA with most infected (790.000) and killed persons (42.200). The comments on the human consequences of this sad catastrophe shall be made by analysts who are more expert in this field.

In the following will only concentrate on the consequences for the tube and pipe industry.

Many countries have decided to lock down major parts of the industry. The international stock markets are flooded with huge amounts of financial support to avoid bankruptcy or unfriendly take overs. Some countries are trying to compensate the corona consequences with financial support also for mid-size and small entities. Major supply and service chains are not working any more. It will take quite some time to recover the well-established globalized production network. In the meantime, the consumption of energy and industrial goods has fallen apart. The tube and pipe industry, unless still protected by long-term delivery contracts is also hard hit by this global pandemic. The by far largest market segment for tubes and pipes is the OCTG (Oil Country Tubular Goods) industry with 51% market share (Figure 1).

The OCTG market is subdivided in pipes used for oil and gas exploration rigs, such as drill pipes, joints, tubing and casings and further downstream line pipes to transport oil and gas.

The OCTG tube and pipe consumption is heavily depending on the number of rigs, as well as the depth of drilling and the capacity of the rigs. The number of new oil and gas rigs itself is heavily depending on the oil price (Figure 2).

The oil price chart of North Sea Brent Oil (Figure 3) shows, after a long period of raising oil prices from early 2016 (41 US$/barrel) to October 2018 (85 US$/barrel), the crude oil price fell down to 53 US$/barrel in only 2 months, to recover to about 72 US$/barrel until April 2019. Since April 2019 to January 2020 the oil price fluctuated between 60 US$/barrel to 68 US$/barrel. These developments were mainly determined by political interventions e.g. in form of imposing trade embargos on oil producing countries like Iran and Venezuela to balance demand and offerings of oil. End of January 2020, the first corona infections were reported from Wuhan/China, and the Chinese government took first countermeasures and shut down parts of social life and their industry. Other countries followed with such measures afterwards. These measures were prompted by a world oil consumption decrease of more than 30% (from about 100 Mio. barrel/day to only 70 Mio. barrel/day). A tremendous oversupply of oil occurred reflected in a crude oil price collapse of about 60% (64 US$/Barrel to 25 US$/barrel in only 5 weeks). The OPEC lead by Saudi Arabia, and major non-OPEC oil producing countries tried to find international agreements to reduce the daily oil production. But due to the significant implications of such measures to some countries first attempts for an agreement failed. Subsequent internal conflicts between the oil producing countries even put further pressure on the oil price level. Only on April 20th the oil producing countries could agree to reduce the world daily production by about 10 Mio. barrel/day for the months May and June 2020. This announcement to reduce the daily production anyhow did not show the desired consequences, since even this reduced production level is by far higher than the present world oil demand caused by industrial lock down due the corona pandemic. The International Energy Agency (IEA) expects, if the industry restarts within May 2020, an overall oil consumption reduction for 2020 of about 9 Mio. barrel/day for the entire year. This may be optimistic, anyhow the agreement of 20th of April by far does not outbalance the reduced demand for crude oil in the present months March and April. Therefore, the crude oil price continued its free fall to 18 US$/barrel as of 19th of April. Unless the world oil demand will raise again or the oil producing countries can agree on further significant reductions on the oil production, the oil price will probably remain on such low level.

The two charts (Figure 4) show the US WTI (West Texas Intermediate) and the European Brent (North Sea Oil) for the last 6 months. Normally the price level of these two dominating brands are quite concurrent. Right now, since the corona pandemic let the oil demand fall apart, the situation seems to get out of balance.

The WTI oil prices has lost by far more compared to the Brent price. WTI is to a great extend subject to trading with futures. The US based oil storage capacities, e.g. at the central US handling location Cushing/Oklahoma, are full and cannot store more oil. Another about 160 Mio. barrel of oil is on its way in tankers swimming on the ocean. The May futures become due; the collapsed market does not take the oil; the oil must be physically taken, unless the oil can be stored by the owner of the future. Therefore the owner of the May oil futures sold at any price. Resulting in a situation that the WTI oil price noted on the 21st of April 2020 at – 37 US$. First time ever the traders had to pay to get rid of their oil!

The European North Sea Brent oil, at the same time noted at about 20 US$/barrel also very low but was not so severely hit by speculation.

Considering the cost of the different countries to produce and pump oil and gas (Figure 5) it becomes obvious how critical it is if the oil prices crashes down to levels, we have seen this April 2020. Considering the cost of the different countries to produce and pump oil and gas (Figure 5) it becomes obvious how critical it is if the oil prices crashes down to levels, we have seen this April 2020.

The oil exploration industry stops its drilling activities at such low oil prices. The USA for example, who became, due to its fracking boom, the largest oil and gas producing country in the world, reduced its horizontal drilling activities by about 26% since March 2020 (Figure 6). The cost to produce US fracking oil is much higher than the present market price. Many analysts even expect bankruptcies of such companies who produce oil at higher prices. At the same time, the storages for OCTG tubes and pipes are filling up causing order volumes and prices sliding down for the tube and pipe industry.

To stimulate the oil market the US president Mr. Trump announced on April 21st to increase the oil demand by enlarging the national oil reserve volume.

The second oil and gas market represent gas and oil pipelines. The pipeline market is a project-based business with long planning periods and high political determinations. Most of such projects are not yet so much affected by the corona pandemic if the relevant global supply chains are working. Pipeline projects are planned in e.g. Europe, USA and Asia. In Europe gas pipelines are mainly built to serve gas from gas and oil fields in Russia and in the North Sea. In the USA the new Keystone XL pipeline is planned to transport oil from Canada to the petrochemical centres in the US. In Asia they shall serve the new petrochemical complexes in Malaysia and Indonesia. All these projects are intensively discussed on political and environmental platforms. The European project “Nord Stream” is a good example, since the US president Mr. Trump and the Polish government are using all their influence to ban this project (Figure 7).

The US government has even imposed trade sanctions on the involved international companies. Although the US oil and gas exports to the EU have been raising significantly, the US government want to ban competition from Russia. - Poland on the other had want to secure its income related to oil and gas being transported through pipelines on their territory. On the other hand, the US pipeline project “Keystone XL” (Figure 8) is supported by Mr. Trump but environmental activists are fighting hard against the project. Due to such interventions is becomes more and more difficult to predict pipeline project developments in the oil and gas business. Therefore, also this market can be considered as difficult in regards of strategical forecasts, which is reflected in the volatile regional production figures of pipeline pipes. If we now take a look at the price level of steel tube and pipes as published by FRED, the US bureau of labor statistics (Figure 9), we can see that the tube and pipe price index since September 2018 weakened from 367 down to 339 in March 2020 (-8%). April figures are not yet published, anyhow it can be expected that tube and pipe prices will drop even more significant.

Besides OCTG, as dominating market, the automotive (15%), mechanical engineering (9%) and construction industry (5%) are also strong market segments for the steel tube and pipe suppliers. The second important market with a market share of 15% is the automotive market. Tubes and pipes with diameters up to 90 mm are mainly applied.

Since 2017, after many years of stable growth, the annual world car sales figure was declining 2018 (-1%) and 2019 (- 4%). 2020e due to the corona pandemic is expected to materialize another significant decline (-16%) of the world car sales (Figure 10).

The automotive industry is characterized by very global supply chain systems, demanding by its just in time deliveries. The car sales figures 2020 dramatically fell apart (e.g. China minus 82% this February) and many OEM and supplier’s production plants were shut down. This April 2020 the world automotive industry is almost totally shut down. Some suppliers report production levels in April and May 2020 of only 20% to 30% of the originally planned production figures. Starting with the Chinese production plants, now also some European and other countries are planning to restart production in May 2020. Anyhow many countries, due to the ongoing corona pandemic, still will not be able to restart its industries. Therefore, it will be a great challenge to restart the complex global supply chains in a reliable way.

Analysts from various well reputed organisations show impressively (Figure 11) how they anticipate the world car sales development throughout 2020. This so called probable scenario was established under the condition that the automotive industry will reliably restart in May 2020 without further delays due to the corona epidemic. It is assumed, that after the dramatic cutbacks in April and May (ab. 70% of original values), the sales volumes will rapidly recover until September 2020.

The tube and pipe industry supplying the automotive industry faces even more challenges if the ramp up would not perform as steep as stipulated in this study. The industry is used to large production lot sizes which will significantly melt down if the ramp up curve would be flatter. In such a case the industry may even not reach minimum critical lot sizes.

The market of mechanical engineering for tubes and pipes, representing 9% of the total tube and pipe market, is quite diversified due to its uncounted applications. The impact due to the corona epidemic will be different for many products. Assuming most companies will postpone any possible capital investment to secure the assets, the demand for tubes and pipes will consequently be reduced as well. The pressure on tube and pipe producers serving this market on production flexibility and efficiency will even further increase over and above the present, already demanding, level.

Another attractive market for tube and pipe producers is the construction market, representing about 5% of the world tube production. The construction market is steadily growing along with the GDP growth. There is some hope, if the world recession would be only of a short duration, as stipulated by many analysts, the construction market and its suppliers would experience only smaller impacts due to the corona epidemic. The growth potential of the construction market is quite impressive (Figure 12).

Another report recently released, Global Construction 2030, forecasts the volume of construction output will grow by 85% to 15.5 trillion worldwide by 2030, with three countries, China, USA and India, leading the way and accounting for 57% of the global growth. The benchmark global study from Global Construction Perspectives and Oxford Economics, show average global construction growth of 3,9%/year to 2030, outpacing that of global GDP by over 1 percentage point, driven by developed countries recovering from economic instability and emerging countries to industrialize. The construction market in India will grow almost twice as fast as China to 2030, providing a new engine of growth in emerging markets. India´s urban population is expected to grow by a another 165 million by 2030, swelling Delhi by further 10,4 million people to become the world´s second largest city. Due to this market potential the Indian chapter of the ITA has just organized a well-attended and most recognized conference in Mumbai regarding the structural applications for tubes and pipes.

When it comes to Europe, whilst it won´t recover to reach pre-crisis levels until 2025, the UK is a growth market, overtaking Germany to become the largest in Europe and the world´s sixth largest construction market by 2030. The mayor market applications for tubes and pipes in the construction market are buildings as e.g. skyscrapers, bridges and load bearing applications. Here we find a significant competition between steel/tube structures and on the other side concrete elements. For skyscrapers the trend in emerging countries to build high-rise towers is supporting the application of steel/tube structures. An outstanding advantage of steel/tube structures are applications for buildings with seismic requirements and/or dynamic loads as applied to bridges.

The success of tube and pipe applications in this mayor segments of the construction market, anyhow require intensified lobbying efforts of the tube and pipe producing industry to further convince regulation authorities and project stake holders about the advantages of steel/tube structures as cost effective, aesthetic and sustainable alternatives to concrete elements. All these steel tube and pipe markets can be subdivided in commodity volume markets and the market part with high-tech requirements. For the high-tech requirements, the decisive factors are the steel quality and the tube plant infrastructure. The steel quality for many high-tech steel tube and pipe applications is demanding regarding chemistry and homogeneity. The availability of such steel qualities with the relevant uniformity and quantities for welded tubes and pipes as steel strip and plates as well as billets for seamless tubes and pipes is limited and creates sometimes a significant hurdle to supply tubes and pipes into such high-tech markets. On the other hand, the tube plant infrastructure regarding tube mills, finishing lines as well as applied quality assurance systems have also a significant importance. Growing importance can be seen in agile management strategies regarding customer benefit, process and product quality enhancement by applying “Industry 4.0” measures. Some interesting applications of “Industry 4.0” in the tube and pipe industry were presented by various speakers at the trend setting ITA tube conference in Düsseldorf 2019.

Plant builders as technology suppliers may find interesting business opportunities in this new market segment. Some technology suppliers have already reacted and complimented their product portfolio by digital solutions.

Dr. Gunther Voswinckel